In this scenario, the insurance company pays a percent of costs 80% or 90%. Typical kinds of health and wellness insurance plan deductibles include: Prescriptions.

cheap cheaper car insurance auto insurance cheaper auto insurance

cheap cheaper car insurance auto insurance cheaper auto insurance

If you get care from a wellness professional or medical center that's not included in your insurance company's network of accepted service providers, you may have to meet a different, out-of-network deductible, and also that one can be higher than for in-network treatment. There are a couple of different means firms take care of family health and wellness insurance coverage plans.

Various other insurance companies impose what's understood as an ingrained deductible, in which each member of your family members must fulfill a collection limit prior to insurance coverage applies to their treatment (car insurance). FAQs, What is the distinction in between an insurance policy costs as well as a deductible?

The team does not keep samples, presents, or fundings of products or services we assess - vehicle. Furthermore, we keep a different company group that has no impact over our method or referrals - insure.

Getting My Auto Insurance Deductible - Rogersgray To Work

You are in charge of the very first $1,000 of problems and your insurance policy business is in charge of the other $1,000 of covered damages. Crash and extensive are both most common protections with a deductible. Accident-- this coverage aids pay for damages to your vehicle if it strikes an additional automobile or item or is struck by another car - car insured.

There are also a few other things to learn about deductibles. There are no deductibles for liability insurance policy, the protection that pays the other person when you create an accident. Car insurance policy deductibles relate to each accident you're in. If you get right into 3 accidents in a plan period as well as have a $500 deductible, you'll typically be accountable for $500 for each claim.

What is an Automobile Insurance Coverage Deductible? Your cars and truck insurance policy deductible is the quantity you'll be liable for paying towards the costs due to a loss before your insurance protection pays.

Picking a higher insurance deductible may lower your vehicle insurance coverage premium. insurance affordable. When Do You Pay an Automobile Insurance Deductible?

$500 Or $1000 Auto Insurance Deductible? - Policy Advice - Questions

What Are Responsibility Limits as well as Exactly How Do They Work? Your car insurance obligation protection restrictions, also referred to as limitation of obligation, are the most your insurance coverage will pay to another event if you are legitimately responsible for an accident. Umbrella policies are not required as well as available protection limits as well as qualification requirements might vary by state.

The ordinary auto insurance coverage deductible is the average amount motorists pay in advance when they have to file a case with their vehicle insurance coverage carriers. After you pay this quantity, the insurance firm covers the cost of the qualifying damage or loss. Choosing an automobile insurance policy deductible can have severe financial effects, so it is necessary to evaluate the different choices with the assistance of an insurance coverage representative to make the best option for you and your family members.

low-cost auto insurance insurance companies insurers accident

low-cost auto insurance insurance companies insurers accident

perks insured car trucks low-cost auto Go to the website insurance

perks insured car trucks low-cost auto Go to the website insurance

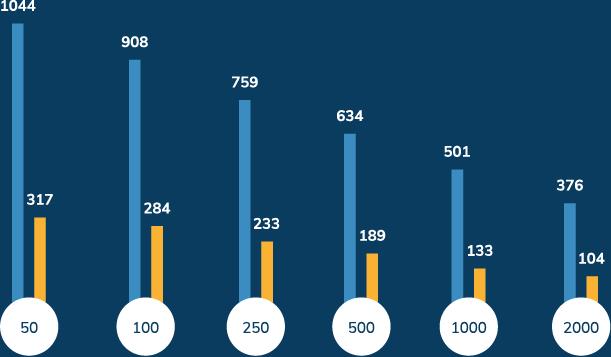

When you choose a greater insurance deductible for your plan, you will pay a lower costs for protection (money). Purse, Hub notes that you can conserve concerning 6 percent by choosing a $2000 insurance deductible rather of a $1000 deductible, which might or may not make good sense depending on the price of your plan.

5 Easy Facts About How Does Car Insurance Deductible Work? - Experian Explained

If you have considerable cost savings, you could like to have a lower insurance deductible and somewhat greater regular monthly payment to stay clear of needing to come up with a larger amount in the occasion of a mishap case. The Balance blog site notes that you should likewise consider your probability of having a claim.

When shopping for an automobile insurance plan, ask each representative to supply you prices estimate with different deductibles. If you would certainly not be able to redeem the cost of your deductible within 3 years of a claim with the lower premium, take into consideration choosing a reduced insurance deductible policy.

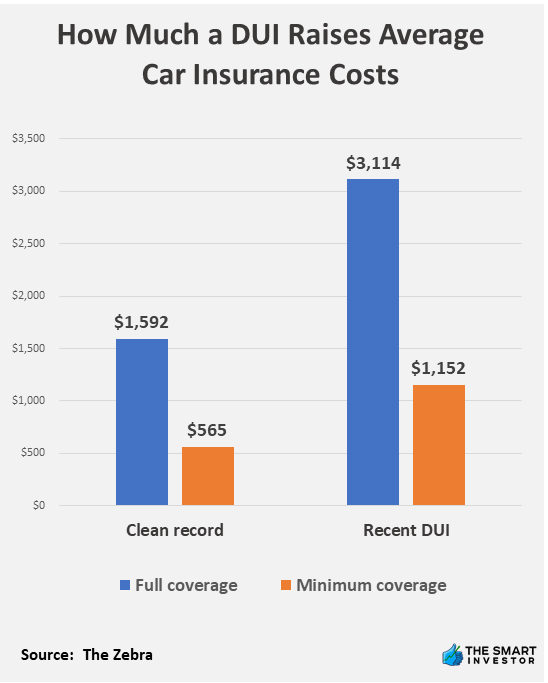

insurance affordable dui cheaper cars cheapest auto insurance

insurance affordable dui cheaper cars cheapest auto insurance

In a situation where you do not have the cash to settle your deductible to an auto mechanic, the insurance provider will send you a look for the damage quote minus the insurance deductible. You would certainly not have enough funds to fix the damage to the car, which could significantly reduce its worth. cheapest auto insurance.

You may have the ability to find more details regarding this and comparable content at (car).

A Biased View of What Is Comprehensive Insurance? - The Hartford

Deductible defined A deductible is the amount of money that you are responsible for paying toward an insured loss. When a calamity strikes your house or you have a cars and truck crash, the deductible is subtracted, or "subtracted," from what your insurance pays toward a case (insured car). Deductibles are how danger is shared between you, the policyholder, as well as your insurance company.<</p>